How To Complete A Bank Guarantee Payment When Employment Agencies Face A Shortage

How To Complete A Bank Guarantee Payment When Employment Agencies Face A Shortage. In the world of employment and recruitment services, bank guarantees play a very important role. They serve as a financial safety net that protects both employees and government authorities. But sometimes, employment agencies face a shortage in their bank guarantee amount, especially when combining multiple activities such as temporary employment, outsourcing, and mediation.

So, what happens when there is a shortage? The answer is simple: the agency must complete the payment of the remaining guarantee amount to the Ministry of Human Resources and Emiratisation (MOHRE) or the relevant authority.

What is a Bank Guarantee in the UAE?

A bank guarantee is a formal promise issued by a bank on behalf of its client (the employment agency) to pay a certain amount of money to a beneficiary (usually MOHRE) if the client fails to meet its contractual or financial obligations.

In simple terms:

- If the agency does not fulfill its commitments, the bank pays the Ministry.

- The agency must then replenish the amount to continue its operations.

This system ensures:

- Security for employees hired through the agency.

- Compliance with labour laws.

- Trust between agencies and the government.

Why Do Employment Agencies Face Shortages in Bank Guarantees?

Employment agencies might face shortages in their bank guarantees for several reasons:

- Combining Activities – When agencies operate in both outsourcing and temporary employment, the required bank guarantee amount increases.

- Regulatory Updates – MOHRE sometimes revises guarantee amounts to ensure better protection for workers.

- Agency Expansion – If the agency hires more workers, the guarantee amount must be topped up.

- Guarantee Invocation – If part of the guarantee was used to settle claims, the agency must refill the shortage.

Conditions & Requirements for Completing a Bank Guarantee Payment

When employment agencies face a shortage, they must follow certain conditions and requirements to complete the payment.

| Requirement | Details |

|---|---|

| Who can apply | Individual institution or legal person (employment agency). |

| Service Category | Employer Service under MOHRE. |

| Target Audience | Employers running outsourcing/temporary employment agencies. |

| Partner Services | Banks, MOHRE Smart App, Service Centers. |

| Fees | None (service itself is free, only guarantee amount is paid). |

| Permit Duration | 2 years (with automatic renewal required). |

| Employment Types Covered | Full-time, part-time, temporary, flexible, remote work, job sharing. |

| Documents Needed | – Reference number |

- Receipt for approval

- Bank guarantee letter

Completing the Bank Guarantee Payment

Here’s the step-by-step process employment agencies must follow when facing a bank guarantee shortage:

Step 1: Identify the Shortage

- Check MOHRE records or the agency’s own accounts.

- Identify exactly how much is missing from the bank guarantee.

Step 2: Prepare the Required Documents

- Print the reference number.

- Collect the receipt for approval from the bank or previous transaction.

Step 3: Submit the Difference

- Visit a MOHRE Service Center, or

- Use the MOHRE Smart App or official website.

- Submit the remaining guarantee amount.

Step 4: Deposit the Amount

- Transfer the required amount via bank.

- Ensure the guarantee is renewed automatically for 2 years.

Step 5: Receive Ministry Approval

- MOHRE updates its electronic system.

- The employment agency’s license gets final approval after the guarantee is fully covered.

Important Considerations for Employers

When completing a bank guarantee payment, employers must remember these key points:

- Automatic Renewal: Bank guarantees must be automatically renewed every two years.

- Beneficiary Rights: If the guarantee is invoked, the Ministry or employees are legally protected.

- Transparency: All transactions are recorded in MOHRE’s electronic systems.

- Service Fees: There are no extra service charges.

Issues Relating to Bank Guarantees in the UAE

Bank guarantees can sometimes cause challenges for employment agencies. Below are some common issues:

1. Amount of Guarantee

- The required guarantee depends on the size of the agency and type of activity.

- Larger agencies may face higher guarantee requirements.

2. Time Limit

- Guarantees must remain valid for at least two years.

- Agencies failing to renew face penalties or license suspension.

3. Assignment & Invocation

- If employees raise disputes, MOHRE may invoke the guarantee.

- Once invoked, the agency must immediately cover the shortage.

Reasons for Bank Guarantees and How to Get One

Agencies need bank guarantees for multiple reasons:

- To protect employees’ rights.

- To secure agency licenses.

- To comply with UAE labour regulations.

How to get a bank guarantee:

- Contact your bank.

- Submit an application.

- Mention the reason (employment agency operations).

- Bank issues the guarantee in favour of MOHRE.

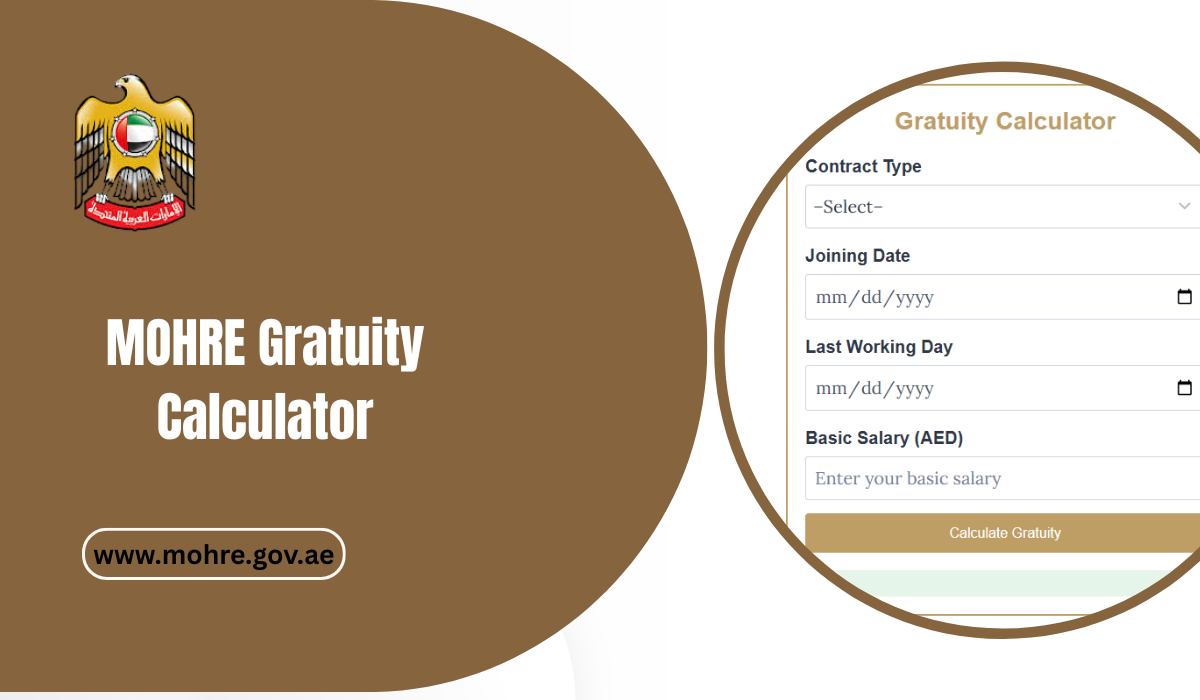

Service Channels to Complete the Payment

Employers can complete the payment shortage using:

- MOHRE Website (official portal).

- MOHRE Smart App (available on iOS/Android).

- Service Centers across UAE.

- Call Center (600590000) – For support.

Customer Notification

Once the request is completed:

- The customer (employment agency) will receive a notification.

- Status can be tracked on:

FAQ About Bank Guarantee Payments in the UAE

What happens if my agency does not complete the payment?

Ans: Your agency’s license may be suspended or cancelled until the shortage is cleared.

Is there a fee for completing the payment?

Ans: No, there are no service fees. You only pay the difference in the guarantee amount.

How long does the process take?

Ans: Service completion duration is usually quick once documents and payments are submitted.

Do I need to renew the guarantee every year?

Ans: No, guarantees are renewed every 2 years, but they must be automatic renewal guarantees.

Can I track my application online?

Ans: Yes, you can track it via MOHRE website, Smart App, or by calling 600590000.

Conclusion

Completing a bank guarantee payment when facing a shortage is an essential process for employment agencies in the UAE. It ensures compliance, protects employee rights, and keeps the agency’s license valid.