MOHRE Gratuity Calculator – Mohre End of Service Calculator

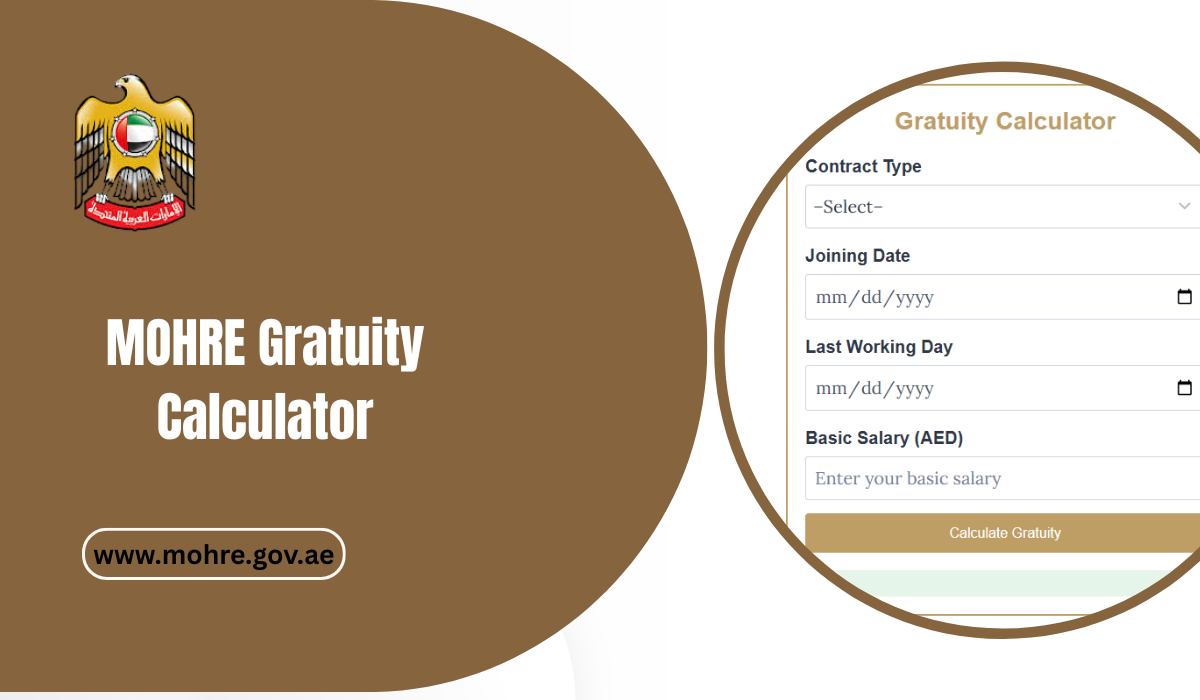

The MOHRE Gratuity Calculator is a easy to use online tool provided by the UAE Ministry of Human Resources and Emiratisation (MOHRE) to help employees estimate their end-of-service benefits accurately. Whether you’re planning to resign or your contract is ending, this calculator gives you a clear breakdown of your gratuity payment based on your length of service and contract type. It is widely used in the UAE and makes sure that all labor laws are followed. This makes it a reliable tool for both expats and businesses.

Gratuity Calculator UAE

How to use this Calculator

How To working Gratuity Calculator

Follow these steps to Calculate Gratuity Payment:

- Enter your “Basic Salary”.

- Please select your “Contract type” like as “Limited or Unlimited”.

- Enter your “Joining Date” and “Last Working Date”.

- Click on the “Calculate” button.

- After click calculate button, to view your “Estimated gratuity amount”.

Disclaimer

This calculator provides an estimated gratuity amount based on input. Actual entitlements may vary based on UAE Labour Law, individual contracts, and employer policies. Please visit the official MOHRE website or legal advisor for official confirmation.

What is Gratuity in the UAE?

Gratuity is a lump-sum payment that employees are entitled to receive when they resign or are terminated, provided they meet specific eligibility requirements. It is part of the UAE Labour Law and is designed to reward long-term service.

Gratuity serves as a financial safety net for expatriate workers who are not covered by pension schemes in the UAE. This is a legal right and is calculated based on your basic salary and duration of service.

Eligibility for Gratuity Pay

To be eligible for gratuity pay in the UAE:

- You must have completed at least one year of continuous service with the same employer.

- Your employment should fall under the UAE Labour Law, including both limited and unlimited contracts.

- You should not be terminated for gross misconduct.

- You should not resign before completing the minimum required service period (under specific conditions for limited contracts).

What is the MOHRE Gratuity Calculator?

The MOHRE Gratuity Calculator is an official tool provided by the Ministry of Human Resources and Emiratisation (MOHRE) to help employees and employers accurately estimate the end-of-service benefits.

This calculator:

- Provides a quick estimation based on your salary and years of service.

- Helps you understand the impact of different contract types (limited vs. unlimited).

- Complies with the UAE Labour Law 2022 and 2023 amendments.

Gratuity Calculation Formulas

For Limited Contracts

- Service Period: 1 to 5 Years

- Gratuity = (Basic Salary × 21 days × Number of Years) ÷ 30

- Service Period: More than 5 Years

- Gratuity = [(Basic Salary × 21 days × 5) + (Basic Salary × 30 days × (Years of Service – 5))] ÷ 30

For Unlimited Contracts

- Resignation

- Less than 1 Year: No gratuity entitlement.

- 1 to 3 Years: One-third of 21 days’ basic salary per year.

- 3 to 5 Years: Two-thirds of 21 days’ basic salary per year.

- More than 5 Years: 21 days’ basic salary for the first five years and 30 days for each additional year.

- Termination by Employer

- Less than 1 Year: No gratuity entitlement.

- 1 to 5 Years: 21 days’ basic salary per year.

- More than 5 Years: 21 days’ basic salary for the first five years and 30 days for each additional year.

Gratuity Calculation Examples

Example 1: Limited Contract (5 Years Service, AED 5,000 Basic Salary)

| Component | Value |

|---|---|

| Contract Type | Limited |

| Basic Salary | AED 5,000 |

| Years of Service | 5 |

| Gratuity (21 Days) | AED 3,500/year |

| Total Gratuity | AED 17,500 |

Example 2: Unlimited Contract (3 Years, AED 4,000 Basic Salary, Resigned)

| Component | Value |

|---|---|

| Gratuity per Year | AED 2,800 |

| Reduction (2/3 rule) | AED 1,867/year |

| Total Gratuity | AED 5,601 |

Gratuity Rules for Limited vs. Unlimited Contracts

| Aspect | Limited Contract | Unlimited Contract |

|---|---|---|

| Early Resignation | May lose gratuity | May receive partial gratuity (1/3 or 2/3) |

| Completion of Term | Full gratuity | Full gratuity if resignation is valid |

| Termination by Employer | Full gratuity | Full gratuity |

Important: Changes in the UAE Labour Law have made it mandatory for all contracts to be limited by 2023. Unlimited contracts are being phased out.

Sample Gratuity Calculation Table

| Scenario | Years of Service | Basic Salary (AED) | Gratuity Entitlement |

|---|---|---|---|

| Resignation after 2 years | 2 | 10,000 | (10,000 × 21 × 2) ÷ 30 × 1/3 = AED 4,666.67 |

| Termination after 4 years | 4 | 12,000 | (12,000 × 21 × 4) ÷ 30 = AED 33,600 |

| Resignation after 6 years | 6 | 15,000 | [(15,000 × 21 × 5) + (15,000 × 30 × 1)] ÷ 30 = AED 52,500 |

Note: These calculations are illustrative; actual amounts may vary based on specific circumstances.

End of Service Payment Components

Gratuity is not the only end-of-service payment. The final settlement may include:

- Pending salary

- Payment for unused leave days

- Bonuses or commissions

- Deductions (if applicable)

Can Employers Deny Gratuity?

Employers are obligated under UAE law to pay gratuity unless the employee:

- Commits gross misconduct

- Resigns without notice under limited contracts (before minimum term)

- Fails to complete one year of continuous service

Impact of Termination Type

| Termination Reason | Gratuity Impact |

|---|---|

| End of contract | Full gratuity |

| Resignation (after 5+ years) | Full gratuity |

| Resignation (1–3 years) | 1/3 gratuity |

| Dismissal (misconduct) | No gratuity |

Common Mistakes to Avoid

- Using total salary instead of basic salary – Gratuity is only calculated on your basic pay.

- Not completing one year – You lose eligibility.

- Confusing calendar year with service year – Service is counted from your employment start date.

- Not keeping contract records – Always maintain copies of your offer letter and labour contract.

Recent UAE Labour Law Amendments Affecting Gratuity (2022–2023)

- All employment contracts must be limited, maximum of 3 years.

- Unified end-of-service benefit structure across all sectors.

- Option for employees to receive gratuity in pension schemes or savings funds.

Benefits of Using the MOHRE Gratuity Calculator

- Quick and accurate estimates

- MOHRE-certified formula

- Easy online access

- Helps avoid disputes during final settlement

- Empowers employees with knowledge of rights

If you face issues related to gratuity or salary settlement, contact MOHRE directly:

| Contact Method | Details |

|---|---|

| Website | www.mohre.gov.ae |

| MOHRE Helpline | 600-590000 |

| Labour Office | Visit any TASHEEL centre near you |

FAQs MOHRE Gratuity Calculator

Is the MOHRE Gratuity Calculator accurate?

Yes, it’s based on official MOHRE formulas and UAE Labour Law. However, always verify final amounts with your HR or legal advisor.

Does gratuity include total salary?

No. Gratuity is calculated on your basic salary only, not including allowances or bonuses.

Can I get gratuity if I resign before completing one year?

No, you must complete at least one year of service to be eligible.

What if I’m on an unlimited contract?

Unlimited contracts are being phased out, but if you’re still on one, gratuity depends on how long you’ve served and the reason for resignation or termination.

How to calculate gratuity in Mohre?

Gratuities are calculated based on the last basic salary you received and the years you have served. For each year of service up to five years, the law uses twenty-one days of basic salary, and for each additional year of service, thirty days of basic salary.

Conclusion

The MOHRE Gratuity Calculator is an essential tool for UAE employees who wish to understand their end-of-service benefits. Whether you’re planning a career change or simply reviewing your entitlements, this calculator helps you stay informed and empowered. With proper understanding of UAE Labour Law and usage of this tool, employees can ensure fair and legal settlements at the end of their service period.