MOHRE ILOE Quick Pay – Iloe Quick Pay Fine

MOHRE ILOE Quick Pay. The Involuntary Loss of Employment (ILOE) Quick Pay system, introduced by the UAE Ministry of Human Resources and Emiratisation (MOHRE), offers a streamlined online platform for employees to manage their unemployment insurance obligations. This service enables workers to check for any outstanding fines related to the ILOE scheme and make prompt payments, ensuring compliance with federal regulations and maintaining eligibility for unemployment benefits. By facilitating easy access to fine information and providing multiple payment options, the ILOE Quick Pay system plays a crucial role in supporting the financial stability of employees during periods of job transition.

Eligibility Criteria of ILOE Quick Pay

The following categories are required to subscribe to the ILOE scheme:

- UAE nationals and residents working in the federal government sector

- Employees in the private sector.

Exemptions apply to:

- Investors and business owners

- Domestic workers

- Temporary contract workers

- Juveniles under 18

- Retirees receiving a pension and joined a new job

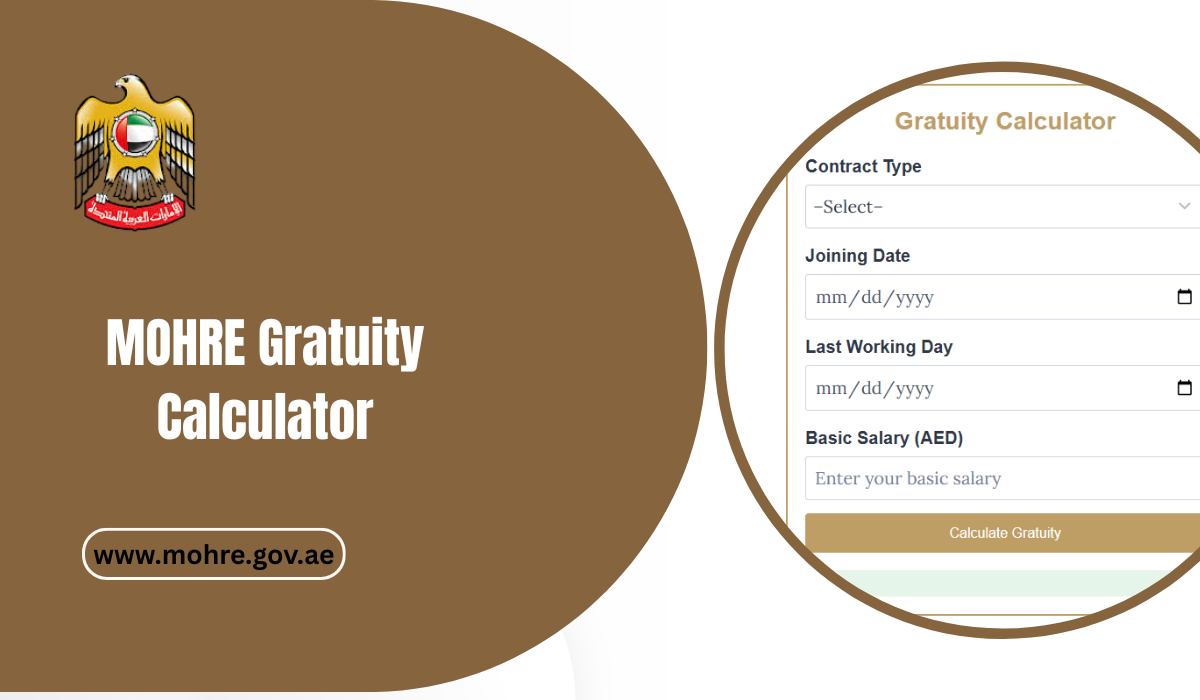

Iloe Quick Pay Fine Check Via MOHRE Website

Follow some steps to check Iloe Quick Pay Fine by MOHRE website

- Visit the “MOHRE ILOE Quick Pay“ website.

- Select the appropriate identification method:

- Emirates ID (EIDA)

- Unified Number (UID)

- Labor Card Number

- Person Code

- Enter the selected identification number and Date.

- Click “Search.” button.

- If a “fine” is present, the system will “display” the details.

How to Use MOHRE ILOE Quick Pay Fine?

To easily check and pay any outstanding fines related to the Involuntary Loss of Employment (ILOE) insurance scheme, follow these simple steps through the MOHRE ILOE Quick Pay platform:

Step 1: Visit the Official Portal

Go to the MOHRE ILOE Quick Pay website via the official MOHRE portal.

Step 2: Choose Your Identification Method

Select one of the following options to proceed:

- Emirates ID (EIDA)

- Unified Number (UID)

- Labor Card Number

- Person Code

Step 3: Input Your Details

Enter the selected identification number along with the date of birth or issue date as required.

Step 4: Click the “Search” Button

Press the “Search” button to allow the system to retrieve your ILOE compliance status.

Step 5: Review Any Fines

If a fine exists, the system will display the full fine amount, due date, and reason for the fine.

Step 6: Provide Contact Information

Input your Registered Mobile Number and Email Address to continue.

Step 7: Proceed to Payment

Click on the “Pay” button to move to the secure payment gateway.

Step 8: Complete the Payment

Finalize the transaction using a credit card, debit card, or other available payment options (e.g., Apple Pay, bank transfer).

What is MOHRE ILOE Quick Pay

MOHRE ILOE Quick Pay is an official online service provided by the Ministry of Human Resources and Emiratisation (MOHRE) in the United Arab Emirates. It allows employees to quickly check and pay fines related to the Involuntary Loss of Employment (ILOE) insurance scheme.

This system is designed for employees who:

- Failed to subscribe to the ILOE scheme on time, or

- Have delayed or missed premium payments

When Are Fines Imposed?

Fines (MOHRE Fine check) are levied in the following scenarios:

- Failure to subscribe to the ILOE scheme within the stipulated timeframe

- Non-payment of premiums for more than three consecutive months

The fines are as follows:

- AED 400 for not subscribing to the ILOE scheme

- AED 200 for missing premium payments for three consecutive months

These fines are subject to VAT and must be settled promptly to avoid further consequences .

How Much Does MOHRE ILOE Quick Pay Cost?

The cost of ILOE Quick Pay premiums is determined by your monthly salary bracket. As your income increases, so does the premium amount. Employees have the flexibility to choose from monthly, quarterly, or annual payment plans, making it easier to stay compliant with the ILOE scheme.

Below is a detailed breakdown of the premium rates and monthly coverage amounts based on salary range:

| Salary Range (AED) | Monthly Premium (AED) | Monthly Coverage Amount (AED) |

|---|---|---|

| Up to 5,000 | 2 | 3,000 |

| 5,001 – 8,000 | 3 | 5,000 |

| 8,001 – 16,000 | 5 | 10,000 |

| 16,001 – 25,000 | 10 | 20,000 |

| 25,001 – 35,000 | 15 | 25,000 |

| 35,001 – 50,000 | 20 | 30,000 |

| 50,001 – 65,000 | 25 | 35,000 |

| 65,001 – 80,000 | 30 | 40,000 |

| 80,001 – 100,000 | 35 | 45,000 |

| Above 100,000 | 40 | 50,000 |

This tiered premium system ensures fair contribution while providing essential income protection. Subscribing to the correct plan helps you avoid fines, remain eligible for benefits, and enjoy peace of mind during times of unemployment.

Iloe Quick Pay Fine Check by MOHRE Mobile App

Follow some steps to Iloe Quick Pay Fine Check by MOHRE App

- Download the “MOHRE UAE app“ from the “Apple App Store” or “Google Play Store”.

- Log in using your UAE Pass or Emirate ID.

- Navigate to the “ILOE Quick Pay” section.

- Select the identification method and

- Enter the Required number and Date and then click Search Button.

- View any outstanding fines and proceed to payment.

Alternative Payment Channels

In addition to the MOHRE website and app, fines can be paid through:

- Authorized exchange centers like Al Ansari Exchange

- Banking apps of participating banks

- Self-service kiosks located in malls and public areas

- MOHRE service centers such as TASHEEL and TAWJEEH.

Who Benefits Most from ILOE Quick Pay?

The ILOE Quick Pay system is designed with UAE workers in mind, providing secure and reliable support during employment transitions. Here are the groups that benefit the most from this online service:

| Group | How They Benefit |

|---|---|

| All UAE Employees | Any employee enrolled under the ILOE scheme can securely manage and settle fines using the platform. |

| Full-Time Employees | Ensures uninterrupted insurance coverage by enabling timely and convenient payments. |

| Part-Time Workers | Offers the flexibility to handle ILOE obligations remotely, without visiting service centers. |

| Individuals Facing Job Loss | Provides quick access to benefit eligibility and financial support after unexpected unemployment. |

| Busy Professionals | Allows employees with demanding schedules to pay fines at any hour, avoiding disruption to their routine. |

| Simplicity Seekers | A user-friendly interface makes the process easy for those who prefer hassle-free digital services. |

| Those Avoiding Late Fees | Built-in alerts and real-time updates help users avoid penalties and missed deadlines. |

Why Choose ILOE Quick Pay?

The MOHRE ILOE Quick Pay system offers a smart, seamless way to manage your unemployment insurance payments in the UAE. Here’s why it’s the go to solution for employees:

- Convenience: Access the platform anytime, anywhere from your smartphone, tablet, or computer.

- Speed: Enjoy fast payment processing that keeps your ILOE coverage active without interruption.

- Security: Your personal and financial data is protected by advanced encryption and secure gateways.

- Paperless Process: Eliminate the need for physical forms and long lines; everything is done online in minutes.

- Transparency: Instantly view your payment history and monitor your insurance status in real time.

- Flexibility: Choose from multiple payment methods including credit/debit cards, mobile wallets, and bank transfers.

The ILOE Quick Pay platform not only saves time and effort but also reinforces the UAE’s commitment to employee welfare and financial stability ensuring you’re protected when it matters most.

Consequences of Non-Compliance

Failing to adhere to the ILOE payment schedule can lead to:

- Fines: As previously mentioned, penalties range from AED 200 to AED 400.

- Suspension of Work Permits: Non-payment may result in the suspension of your work permit.

- Salary Deductions: Outstanding fines can be deducted directly from your wages or end-of-service benefits.

- Ineligibility for Benefits: Non-compliant employees cannot claim unemployment benefits under the ILOE scheme.

Benefits of Using ILOE Quick Pay

- Convenience: Access the service online anytime, eliminating the need for physical visits.

- Efficiency: Quickly check and settle fines, ensuring compliance with the ILOE scheme.

- Security: Secure payment gateways protect personal and financial information.

- Record Keeping: Receive digital receipts for all transactions, aiding in personal record maintenance.

FAQs About MOHRE ILOE Quick Pay

Who is required to subscribe to the ILOE scheme?

Ans: All employees in the UAE’s federal government and private sectors, excluding investors, domestic workers, temporary contract workers, juveniles under 18, and retirees receiving a pension.

How can I check if I have any ILOE fines?

Ans: Use the MOHRE website or mobile app’s “ILOE Quick Pay” feature to view any outstanding fines.

What payment methods are accepted?

Ans: Payments can be made using credit/debit cards, bank transfers, or e-wallets like Apple Pay and Samsung Pay.

Conclusion

The MOHRE ILOE Quick Pay system is an essential tool for UAE employees to manage their unemployment insurance obligations efficiently. By ensuring timely payments and maintaining compliance, employees safeguard their eligibility for benefits and avoid potential penalties. Utilizing the Quick Pay platform not only simplifies the payment process but also reinforces financial stability during unforeseen employment disruptions.